Should Beauty Pros Set Up an Electronic Federal Tax Payment System (EFTPS) Account?

There are a few different ways you can pay your Federal taxes: mail (yuck), online through Direct Pay (doesn't require you to set up an account), and EFTPS (requires an account, but has extra perks).

We're going to talk about EFTPS today.

What is EFTPS?

EFTPS or Electronic Federal Tax Payment System (say that 5 times fast) is a free service provided by the United States Department of the Treasury that allows taxpayers to put together a tax payment either by telephone or online. But seriously, who uses the phone when there's an online option? This system is accessible every day of the week, 24 hours a day - unlike the IRS call centers.

This system can be utilized by individuals or corporations seeking to make payments on income taxes. The main benefit is the convenience of making a secure payment at a scheduled time.

Do I need an account on EFTPS?

You are not required to enroll in EFTPS, but there is a perk we'll discuss below.

Even if I'm not required to have an eftps.gov account, can I still benefit from it?

Here's why you should consider setting up an EFTPS account even though it's not required.

- You can schedule your estimated payments so it's one less thing to think about

- You can easily track the payments when you go to do your taxes

Steps on How to Sign up for an EFTPS Account

Now that I've convinced you it'd be a good idea, here's how you can do it.

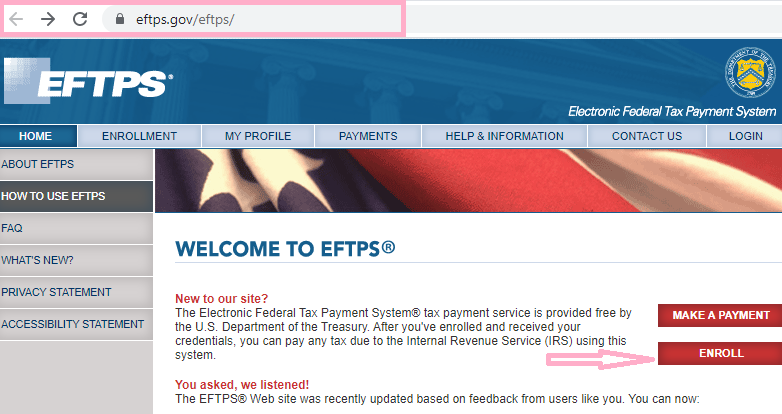

1. Go to https://www.eftps.gov/eftps and click on "ENROLL"

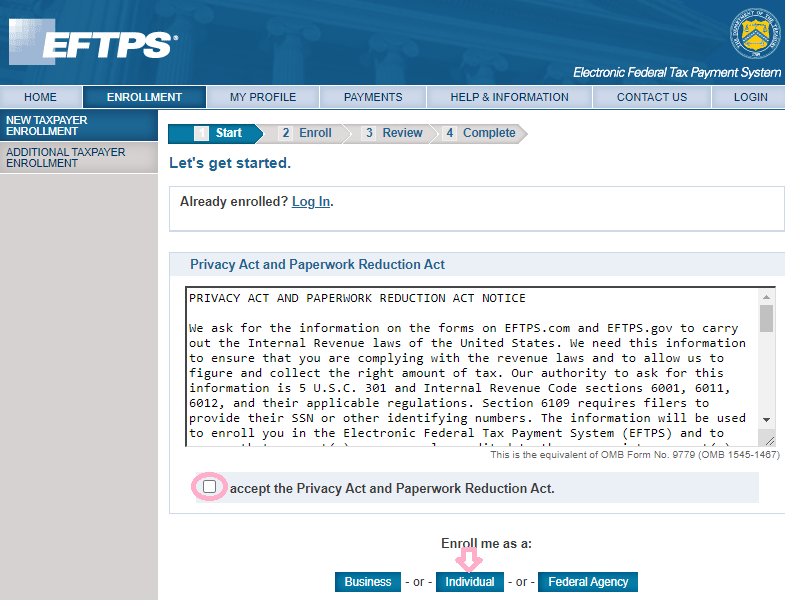

2. Check the box beside the "I accept the Privacy Act and Paperwork Reduction Act. and click in "Individual"

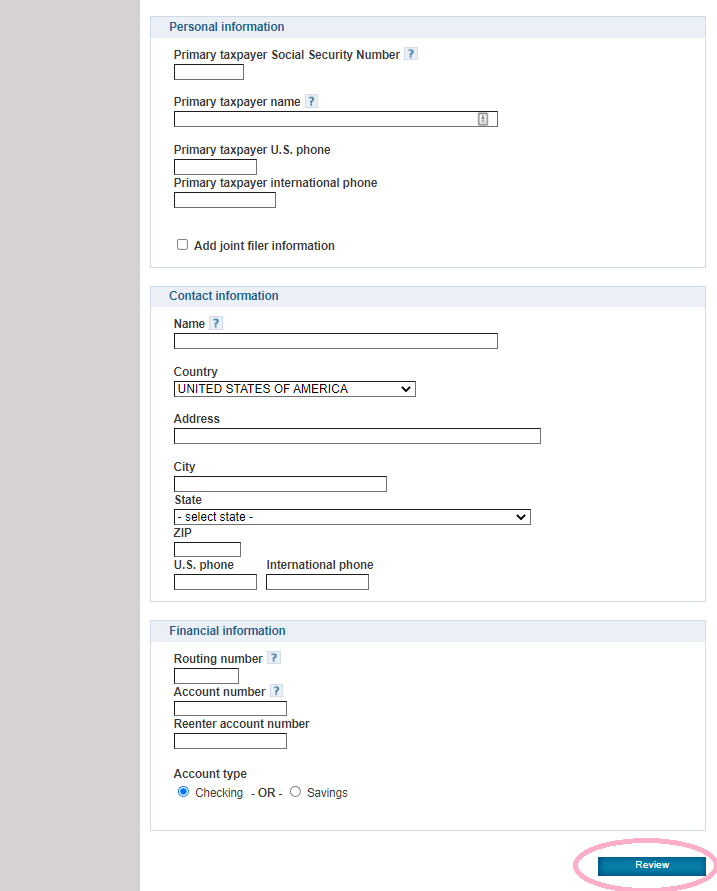

3. Fill up the form and click on "Review".

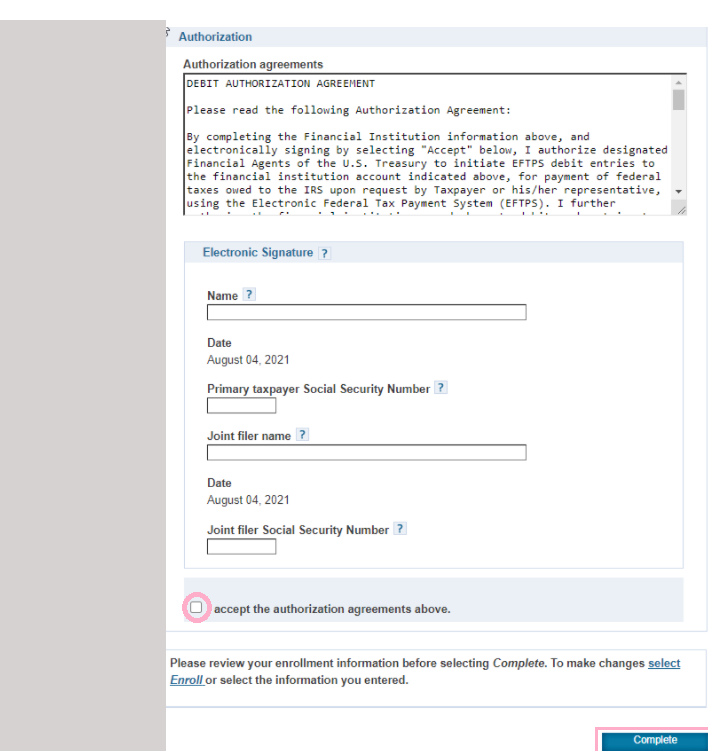

4. Scroll down and check the box beside "I accept the authorization agreements above" and complete the form.

That's it. You will receive a pin in the mail, which will allow you to log into your account.

Do I Set the Account Up Under My Personal Name or Business Name?

Most small business owners make income tax payments at the personal level. That means you'll want to register under your personal name, NOT your business name, for income tax payments if you own a sole proprietorship, LLC, S-Corp, or Partnership.

Corporations do pay income tax so they will need their own account. It's pretty rare for a beauty business to own a corporation. If you do, make sure to talk to your accountant about if it makes sense to make an S-election.

Exception: Since this is taxes, there's an exception to every rule. If you own a sole proprietorship, LLC, S-Corp, or Partnership and you also run payroll, then you may want to set up an EFTPS account to pay your payroll taxes. Work with your payroll provider to see if this is needed.